Let’s pretend: Worst-case scenario for your retirement

OK, so you’ve retired, left the grind behind. You’re looking forward to golf, volunteering, spending time with the grandkids.

Oops… You’ve forgotten one thing: What if your money runs out before you do?

The question is simple, but arriving at an answer that won’t keep you up at night is not. It involves a thorough analysis of your retirement objectives, thoughtful implementation of strategies designed to improve your level of success, and regular follow up.

-

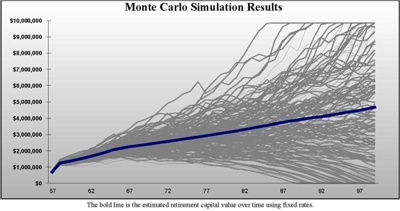

Chart shows the result of 5,000 retirement simulations. Client achieved success (did not run out of money) in 89% of the scenarios. Horizontal axis is age.

Assessing a retirement goal is one of the biggest issues for our clients and for us as financial planners. It involves gathering data related to income, expenses, lifestyle changes and investments. It includes making clear-headed, conservative assumptions related to inflation, the need for medical care and investment returns.

Then the fun begins: Looking at 5,000 potential retirement scenarios that attempt to simulate the best and worst possible retirement for you, based on your situation.

When the result of these simulations shows a high level of failure defined as running out of money before final life expectancy it tells us that there is more work to do.

The following options usually produce better results:

- Introduce a guaranteed, lifetime fixed-income stream (immediate annuity) to the scenario;

- Retire later;

- Invest more aggressively;

- Reduce lifestyle expectations.

Beyond the analysis, our planning work involves additional considerations: Tax efficiency, estate planning and maintaining a high level of financial flexibility so that even in worst-case scenarios (high inflation, low return, high taxes) you can still achieve success.

And of course, because even we can’t predict the future, it’s important to stay on top of your retirement by revisiting the issues at least once a year to make sure you’re still on track.